What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in the global market. It is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. what is trading forex fx-trading-uz.com offers resources that can help traders understand the intricacies of this dynamic market. This article delves into the fundamentals of Forex trading, its mechanics, strategies, and how to get started.

How Forex Trading Works

At its core, Forex trading involves exchanging one currency for another. Currencies are always traded in pairs, such as the euro against the US dollar (EUR/USD) or the British pound against the Japanese yen (GBP/JPY). The value of a currency pair fluctuates based on factors like economic indicators, interest rates, political stability, and overall market demand.

Currency Pairs

Currencies are categorized into three main types of pairs:

- Major Pairs: These include the most traded currencies, such as USD, EUR, GBP, and JPY. For example, EUR/USD is a major pair because it includes the euro and US dollar.

- Minor Pairs: These pairs do not involve the US dollar but include other major currencies. An example is EUR/GBP.

- Exotic Pairs: These consist of a major currency paired with a currency from a developing economy, like USD/TRY (US dollar vs. Turkish lira).

Understanding Forex Quotes

A Forex quote shows how much of the second currency is needed to purchase one unit of the first currency in the pair. For example, if the EUR/USD exchange rate is 1.2000, it means 1 euro is equal to 1.20 US dollars. Forex quotes usually display two prices:

- Bid Price: The price at which the market will buy a specific currency pair from you.

- Ask Price: The price at which the market will sell a specific currency pair to you.

Forex Trading Strategies

Successful Forex traders often employ various strategies and analysis techniques. Here are a few common approaches:

1. Technical Analysis

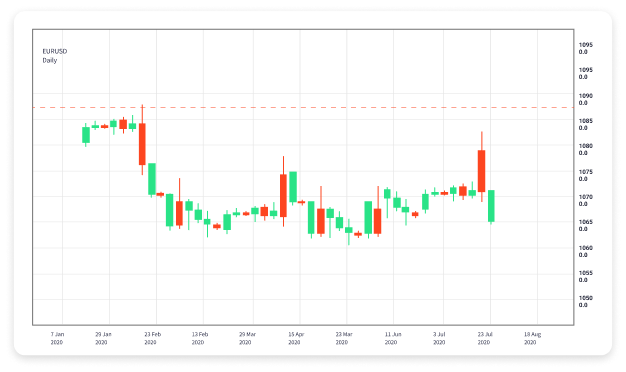

Technical analysis involves analyzing price charts and using indicators to forecast future price movements based on historical data. Traders look for patterns, resistance and support levels, and other dynamics to inform their decisions.

2. Fundamental Analysis

This strategy focuses on economic indicators, news events, and reports that can impact currency values. Understanding macroeconomic factors, such as GDP growth or employment rates, can provide insights into currency movements.

3. Sentiment Analysis

Sentiment analysis entails gauging market sentiment or trader psychology. This often involves looking at various indicators, including the Commitments of Traders (COT) report, to determine the market’s mood—whether bullish or bearish.

Getting Started with Forex Trading

If you’re considering diving into Forex trading, here are essential steps to follow:

1. Education

Start by educating yourself about the Forex market. Numerous online resources, courses, and tutorials can help you get a strong foundation.

2. Choose a Reliable Broker

Select a reputable Forex broker to facilitate your trades. Look for one that is regulated, offers a user-friendly trading platform, and has a robust customer support system.

3. Practice with a Demo Account

Consider opening a demo account to practice trading without risking real money. This allows you to familiarize yourself with the trading platform and develop your strategies.

4. Develop a Trading Plan

Your trading plan should outline your goals, risk tolerance, and the strategies you intend to use. Stick to your plan and avoid emotional trading.

5. Start Trading

Once you feel confident, start trading with real money. Begin with small investments and gradually scale up as you gain more experience.

Risk Management in Forex Trading

Risk management is crucial in Forex trading, as it helps protect your capital and reduces the chance of significant losses. Consider these risk management techniques:

- Use Stop-Loss Orders: Set predefined prices at which your position will automatically close to limit losses.

- Position Sizing: Determine the size of your trades based on your account size and risk tolerance.

- Diversify: Avoid putting all your capital in one trade or currency pair to spread risk.

Conclusion

Forex trading offers opportunities for profit, making it an appealing venture for many. However, it comes with risks that necessitate a thorough understanding of the market. With education, practice, and a well-defined strategy, new traders can increase their chances of success in this intricate and exciting arena. The key lies in being informed, disciplined, and adaptable to market changes.